The Tongan government will look at the Dubai-based Validus after the New Zealand Financial Market Authority put a temporary ban on the promotion of the company’s multi-level marketing scheme.

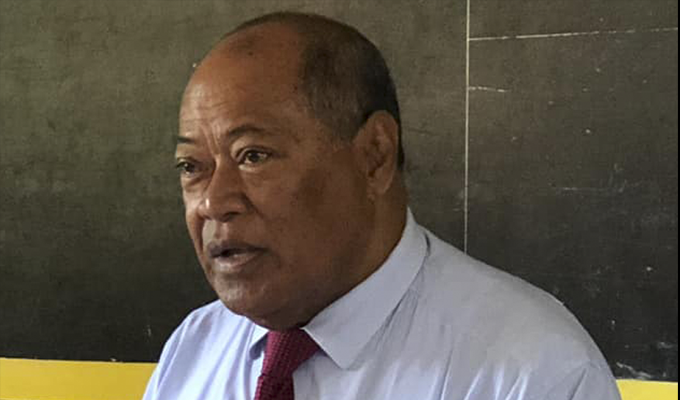

The Deputy Prime Minister and Minister of Justice Samiu Vaipulu has confirmed this to Kaniva News this morning.

“‘E fai ‘a e ngāue ki ai”, he said in Tongan.

Promoters of Validus, which is registered in the United States, are prohibited in New Zealand from:

- making offers, issues, sales or other acquisitions or disposals of financial products promoted under the brand or name Validus; and

- accepting applications for financial products promoted under the brand or name Validus; and

- distributing any restricted communication that relates to:

- the offer, or intended offer, of financial products promoted under the brand or name Validus; and/or

- the supply, or possible supply, of a financial advice service to any person; and

- accepting further contributions, investments, or deposits in respect of financial products promoted under the brand or name Validus; and

- supplying a financial advice service to any person; and

- supplying the financial service of keeping, investing, administering, or managing money, securities, or investment portfolios on behalf of other persons”.

The FMA previously said: “We are concerned that Validus is operating in breach of the New Zealand financial markets legislation”.

“Validus is providing financial services in New Zealand without registration as a financial service provider as required by the Financial Service Providers (Registration and Dispute Resolution) Act 2008.

“We strongly recommend that investors do not trade or invest with entities that are not registered and/or licensed in New Zealand.”

The company has expanded its services to include Tonga with promoters from Australia and New Zealand arriving in the kingdom recently.

It came after promotions on social media including setting up of a Facebook account under the name Validus Tonga. It has more than a thousand followers.

It is understood Validus promoters held various meetings in Tongatapu including Nukunuku and Malapo this month.

Pyramid scheme

The Australian Securities & Investment Commission said Validus is a scam and warned people to be wary of the company.

“Validus encourages investors to recruit new investors into the scheme. This is a classical sign of a pyramid scheme”, it said.

Pyramid scheme is a form of investment illegal in Tonga, Australia, New Zealand and elsewhere in which each paying participant recruits two or more further participants, with returns being given to early participants using money contributed by later ones.

The Tongan community has already been affected by scams, including pyramid schemes in which people have lost hundreds of thousands of dollars.

Last year, two women had been found guilty at the Nuku’alofa Supreme Court for running a pyramid scheme.

The two accused, Viola Tupa (Tupa), and ‘Anaseini Pongi (Pongi) were charged with advertising a scheme in Kolomotu’a , where profits earned by participants in the scheme largely depended on increases in the number of participants in the scheme.

In 2021 it was reported that Tongans in New Zealand who put thousands of dollars into pyramid scheme, Tongi Tupe Nu’usila, have been left without cash for food or rent as the country is plunged into lockdown.

“Those recruited into the scheme are told if they put in anything from $2,500 – $10,000, after three weeks they can turn up to collect big money every Saturday, turning over profits of thousands of dollars”.

Unanswered questions

People who attended Validus meetings in New Zealand had been left with many unanswered questions.

They asked “why it was when you Google the one American residential address posted on one of the company’s several websites, several other firms with the same address”.

“I wanted to know why his firm was offering financial services but had not registered with any of the financial regulators in the countries in which it was operating.

“I wanted to hear his response to a warning by the Australian Securities & Investment Commission that Validus “had classical signs of a pyramid scheme”.

“I wanted to know why it seemed as if the only way to make money in Validus was to recruit others to join”.