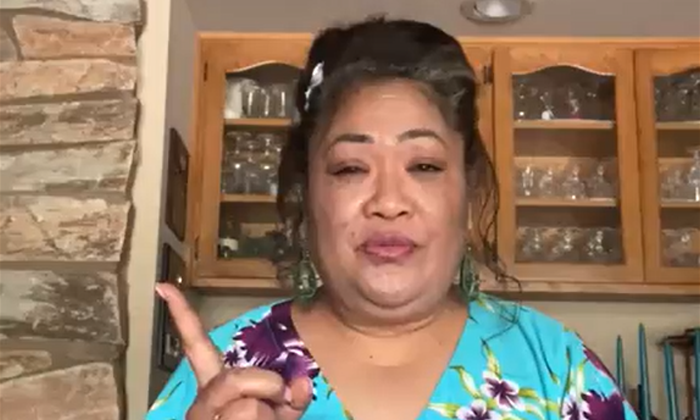

The woman who widely promoted a fraudulent investing scam in the US has called on Tongan investors to immediately stop depositing any more money in the Hyperfund ponzi scheme.

Setaita Folau Tānaki said people who had invested $100,000 and more in the scam had been unable to withdraw their money.

Only Tanaki and people who had invested less than $100,000 had been able to withdraw their money, she recently said in a livestreamed video.

Hyperfund, which was later rebranded as Hyperverse after warnings from regulators, was promoted as a scheme which offered a 300% return of investment to investors.

New Zealand and the UK had previously warned that Hyperverse may be promoting a scam.

READ MORE:

- Tongans in US try to recruit new members for scheme that promises huge wealth to investors

- Supreme Court convicts two for running pyramid scheme that recruited church members

- Court rules pyramid scheme must pay back investor’s money, but legal battle continues

- Financial authority issues ‘interim stop order’ against Validus company

The scheme reportedly collapsed in 2021 before its founders and top promoters fled to Dubai with their investors’ money.

One of its top promoters was Kalpesh Patel, a UK citizen who lives in Dubai. Patel was active for many years in promoting pyramid schemes, scams, frauds and money laundering around the world.

Reports claimed he was making an estimated $3 million per month while he was involved with Hyperverse.

It appeared the Tongan investors were just recently made aware of the company’s downfall, which was publicly confirmed after Tanaki appeared in a livestreamed video on February 22 this year.

“Do not deposit any more money,” she warned her Facebook followers.

She said the next step was for the victims to fill a form and submit it online so that Sam Lee, one of the founders of the Hyperverse could try to “recover” their money.

“This man [Sam Lee] previously said he did not want us to make further deposit,” Tanaki reiterated.

“If someone tells you to deposit more money no. Not yet. Just wait”.

“Those of you who have invested tens of thousands, thousands and hundreds and have yet to withdraw it Sam Lee will be here in an attempt to refund their money”.

Tānaki, was visibly concerned and spoke in such a low voice that her listeners warned her on the Facebook comment section to speak louder so they could hear her. She is still a member of Hyperverse, but said she kept her membership only because she felt for those Tongans whose money had gone missing in the scam.

She said Lee was expected to provide another scheme which was better than Hyperverse. She said it was intended to make sure this problem did not occur again in the future.

Tānaki, who appeared to be based in Utah, said Lee had already announced on one of his YouTube videos that those who had yet to receive their money must fill a form but she implied that there was a training to be conducted on how to fill the form.

She said Lee wanted to obtain the names of the victims so he could help them retrieve their money.

However, she also said: “Filling the form does not mean he will send your money right away. No it isn’t. I want to assure you that.

“The form is another way of bringing the community together in and he will look into that, he will see what had happened and after that your money will be paid back.

“So this is the beginning of the submission of the forms so he could work on them.”

Despite the collapse of the scheme and many Tongans losing thousands, Tānaki still took great pride in scammer Lee and the leaders of the Hyperfund.

“The promoters who are senior to me are working together with this man (Lee) and I am greatly thankful for him. He is very faithful. He brought himself into this community. The Tongan community so that we can see a light at the end of the tunnel”, Tānaki said.

“He is a very smart man. Let’s see what he will be able to do”.

Tānaki’s latest video provided what appeared to be another misleading, ambiguous and conflicting information to the victims on how they should get their money back.

She said the victims must submit a form which showed their names and contact details but there was no promise their money will be refunded.

One may ask, why were victims asked to resubmit their details when all investors must initially have created their own accounts on Hyperverse website where they provided their names and contact details.

Tānaki’s 2021 campaigns

Tanaki assured the Tongan international community in 2021 that Hyperfund was just like any other financial company.

She previously claimed she had received rewards of US$200 daily and she urged Tongans in New Zealand and Australia as well as yard workers in the US join in.

However, in one of her meetings at the time with members of the Tongan community some potential investors accused her of promoting a scam. The accusers argued that Hyperfund had no physical office and there was no legal paperwork for members to sign up with the company. Tanaki vehemently denied this at the time and urged people to invest, insisting the company was real.

In its warning at the time, the New Zealand’s Financial Markets Authority said “HyperFund may be operating a scam”.

It said HyperFund operated on a Multi-Level Marketing (MLM) model and claimed to offer passive investment opportunities.

“We have received reports of them recruiting affiliate investors in New Zealand. It is not registered or licensed to provide financial services/products in New Zealand”.

The warning by FMA on September 30, 2021 came a month after Kaniva News published a story on August 30, 2021 titled “Tongans in US try to recruit new members for scheme that promises huge wealth to investors.”

In that story we said: “Kaniva News has learned that Tongans who have bought into the scheme have been promising potential recruits a big payday”.

It also came before the New Zealand FMA placed a temporary stop order on the Validus multi-level marketing scheme and the people promoting it, last month.

The New Zealand and Australian authorities have warned that Validus may be promoting a Ponzi scheme.

A Ponzi scheme is a fraudulent investing scam which generates returns for earlier investors with money taken from later investors.

The website thehyperfund.com now redirects to thehyperverse.net

The UK’s Financial Conduct Authority cautioned the public about HyperFund on 23 March 2021. View the warning.

Additionally, Guernsey Financial Services Commission have also warned about HyperFund.

The FMA recommend exercising caution when dealing with this entity.

Entity name: Hyperfund

Websites: thehyperfund.com; thehyperverse.net