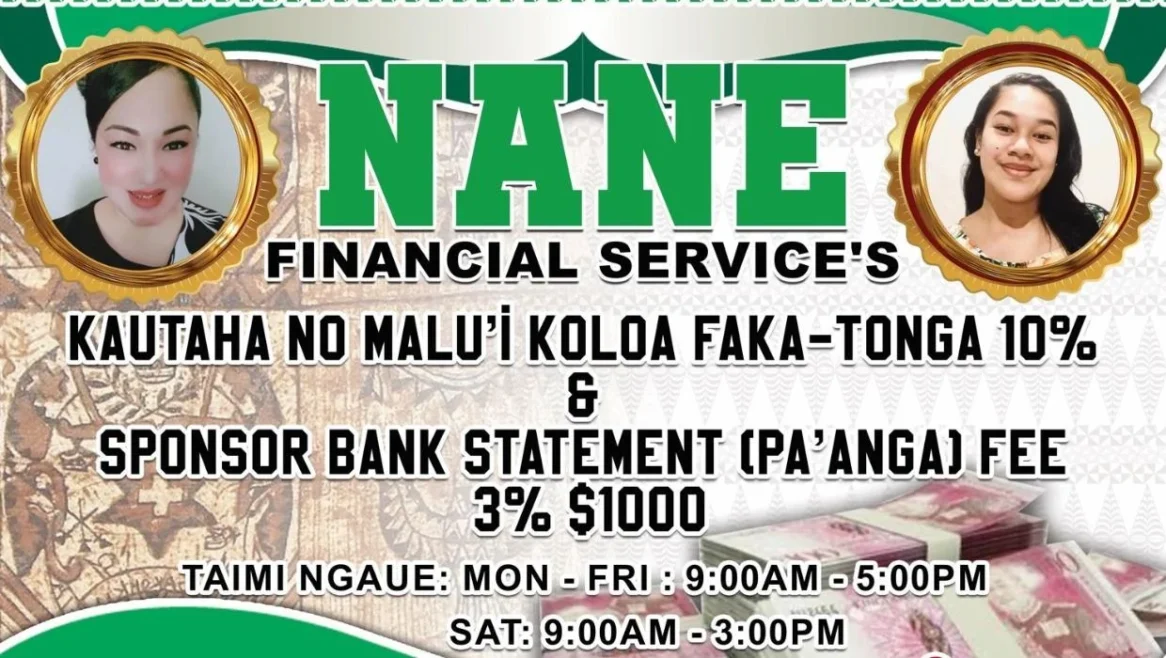

Auckland, NZ – The Commerce Commission has filed criminal charges in the Auckland District Court against Ilaisaane Malupo, an unregistered lender trading as Nane Easy Loan Finance Services NZ (Nane Loans).

The Commission alleges Ms Malupo illegally provided high-interest personal loans to members of Tonga’s South Auckland community since March 2024, exploiting vulnerable borrowers already facing financial hardship.

Associate Commissioner Joseph Liava’a stated the Commission takes swift action against unregistered lenders to protect consumers.

“Often these kinds of lenders are a last resort for people who are struggling to borrow from reputable lenders.

Many people who borrowed from Ms Malupo were already under financial pressure and on low incomes, so irresponsible lending could have had a big impact on borrowers and their families,” Mr Liava’a says.

Investigations revealed Ms Malupo charged exorbitant weekly interest rates of 15%, which doubled if loans weren’t repaid within 28 days, along with daily late fees of $10.

Many borrowers reportedly took loans for essentials like food or to pay existing debts, with some forced to sell personal belongings or miss rent payments to keep up with repayments.

The Commission found Ms Malupo operated primarily through social media, where she allegedly threatened to publicly shame defaulting borrowers on Facebook and Tongan media platforms until debts were settled.

“Public shaming is unacceptable and puts vulnerable people at greater risk,” Mr Liava’a emphasised.

Ms Malupo faces serious charges under the Financial Service Providers Act for operating without registration, carrying potential penalties of 12 months’ imprisonment or fines up to $100,000.

Additional charges under the Commerce Act for allegedly misleading the Commission could result in further $100,000 fines. The Commission has prioritised stopping her from issuing new loans or enforcing existing ones while its investigation continues.

The Commerce Commission continues to investigate similar cases across Auckland’s Pacific neighborhoods as part of its ongoing efforts to ensure fair lending practices for all New Zealanders.